Senior housing indicators looking up

In the senior housing sector, cap rates are dropping and rents are rising.

Investment opportunities in the senior housing sector are rising in tandem with rising rents and dropping cap rates. That’s according to the recent CBRE Senior Housing & Care Investor Survey. The 2024 edition of the survey is the organization’s 14th polling of top private and institutional investors, brokers, and other real estate pros. It offers an overview of industry trends according to the people who know and understand it best.

2024 Survey findings on senior housing trends

Let’s take a closer look at this year’s survey findings on senior housing indicators and trends, which can illuminate possible implications for investors and developers in the Coulee Region and Rochester, MN.

Cap rates

Last year’s survey indicated widespread consensus of increasing cap rates, pushed upward by labor shortages and inflationary pressures. This year, about half of respondents reported cap rates were unchanged, while the average cap rate in the senior housing sector increased by 16 basis points between October 2023 and March 2024. Skilled nursing cap rates were up by 11 basis points over that period, and comparatively, in the six months before that, they increase by 71 basis points. Average cap rates for assisted living, memory care and independent living facilities were up 17-20 basis points over the past six months.

There was also a shift in asset classes experiencing the greatest increases, which most recently are being seen in Class C assets and non-core markets. Still, 45% of respondents said there was no change in senior housing cap rates from the previous survey. Of note: surveyors polled the same group of professionals and investors as they had in the previous survey, with a 98% response rate.

Rental rate increases

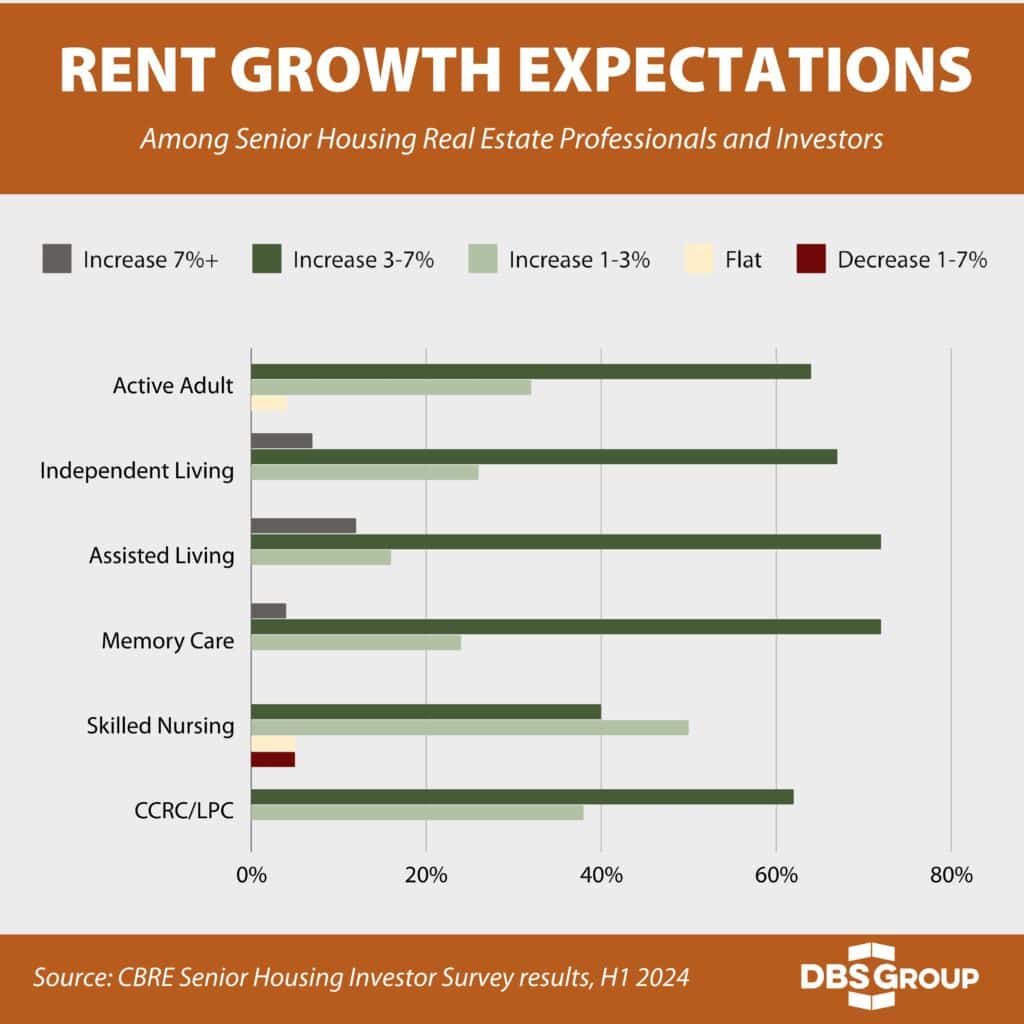

According to the survey respondents, rental rate increases are expected over the next year in all asset classes but one: the skilled nursing asset class. Meantime, none of the respondents reported expecting rent decreases regardless of asset class. Respondents who expressed rent growth expectations above 7% moderated over the previous survey, falling from 15.6% to 3.9% in the most recent report. Still, most respondents reportedly expect a rent increase of 3% to 7% in Active Adult, Independent Living, Assisted Living, Memory Care and CCRC/LPC sectors.

Senior housing indicators show favorable signs

After navigating several challenging years driven by labor shortages, a pandemic, and economic instability with climbing interest rates, the senior housing sector seems to be regaining its footing, according to this survey and numerous other economic indicators for the industry. If you’re considering entering the senior housing development landscape, the design-build model of construction and the expertise of our seasoned senior housing construction professionals can help you be competitive in the marketplace. Contact us to discuss how design-build makes a huge difference for your investment in the senior housing sector in Rochester, MN, the 7 Rivers Region and beyond.